QUESTION: How is the Renter's Cost of Living calculated in the Geographic List?

The Renter’s Cost of Living is a value that comes from ERI's Relocation Assessor. It represents a comparison for a given location to the National Average given the mean salary for the selected occupation. This field allows users to compare salary to cost of living given a common benchmark (National Average).

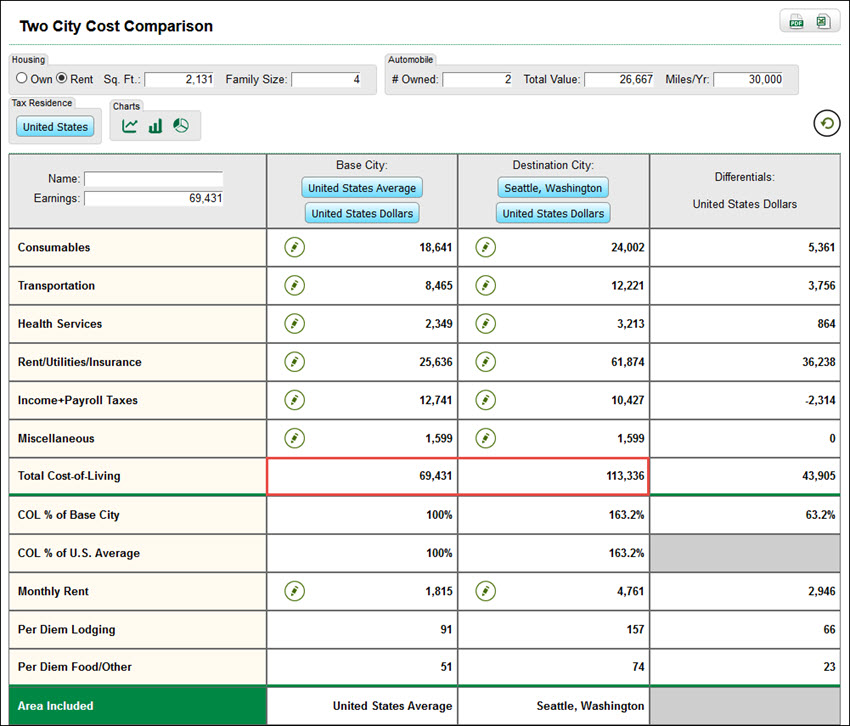

The Renter’s Cost of Living value in the example below is for an Accountant in Seattle, WA ($112,836). This is seen in the first line of the Geographic List in the Salary Assessor screenshot. The second line is the salary for an Accountant at the United States Average. The mean salary for the United States Average is the comparison point ($69,431). This comparison point is used so all locations in the geographic list are compared against a common value.

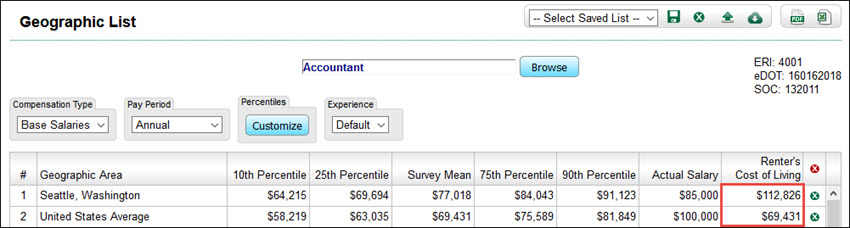

The second screenshot below comes from the Relocation Assessor and shows how the actual comparison is made. The base city is “United States Average,” and the destination city is “Seattle, Washington”. The US national average salary for Accountant is entered as the earnings in the spreadsheet ($69,431). This gives us a total cost of living in Seattle of $113,336 (compared to $69,431 at the national average). This means that an Accountant earning the national average salary of $69,431 would have to earn $113,336 in Seattle to maintain the same standard of living as is found at the United States Average.

You will notice that there is a $500 difference between the cost of living values presented in the Salary Assessor ($112,836) and the Relocation Assessor ($113,336). This difference is due to a slight simplification of the regression equations used for this calculation in the Salary Assessor vs. the Relocation Assessor. Specifically, the Relocation Assessor uses a form of cubic regression, whereas the Salary Assessor uses a form of linear regression.

Salary Assessor:

Relocation Assessor: