ERI models the estimated impact of combined employee income taxes, including federal, state/provincial, and local (specific city or county, if existent), along with federal and local payroll taxes (e.g., FICA, FUTA, etc.), flat taxes, surtaxes, employee-paid disability and employee-paid unemployment rates. Rates are "effective" (actual paid divided by earnings) and not "marginal" (rate paid on next $1 of earnings). In the US, family size and marital status assumptions will affect total combined taxes due to deductions and tax credits. For Canadian tax estimates, a single wage earner is assumed regardless of the family size selected. Also, in the US only, mortgage interest payments are tax deductible (for comparisons which have been altered by the user to model a home ownership situation). Please note that mortgage interest payments are not tax deductible in Canada. See US Mortgage Interest Deduction - Two Kinds of Debt for more information.

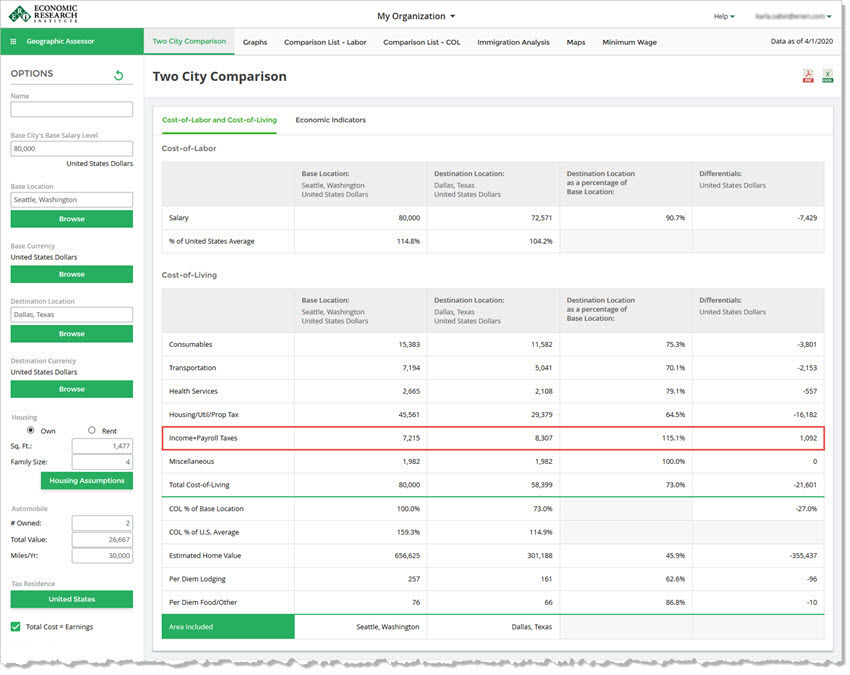

User modifications to the Income + Payroll Taxes field will impact the cost-of-living differentials reported by the Two City Comparison table only.

Note: ERI estimates are not intended as substitution for legal counsel. All tax planning should be assisted by the expertise of an international tax consultant.

For more information, also see:

Using GA FAQ #9 (State Income Tax)

Using GA FAQ #15 (the option to "Never Use Tax Equalization")

See Two City Comparison - Background for more information.