QUESTION: What happens if I select to "Never" use tax equalization?

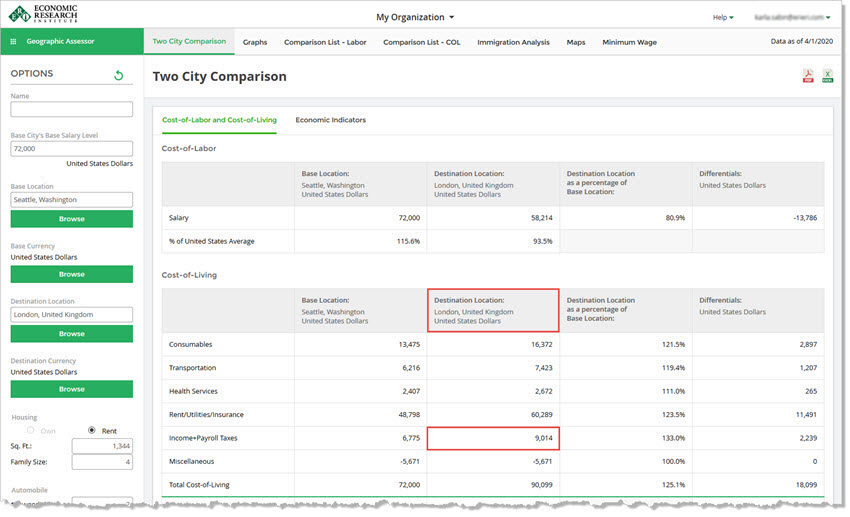

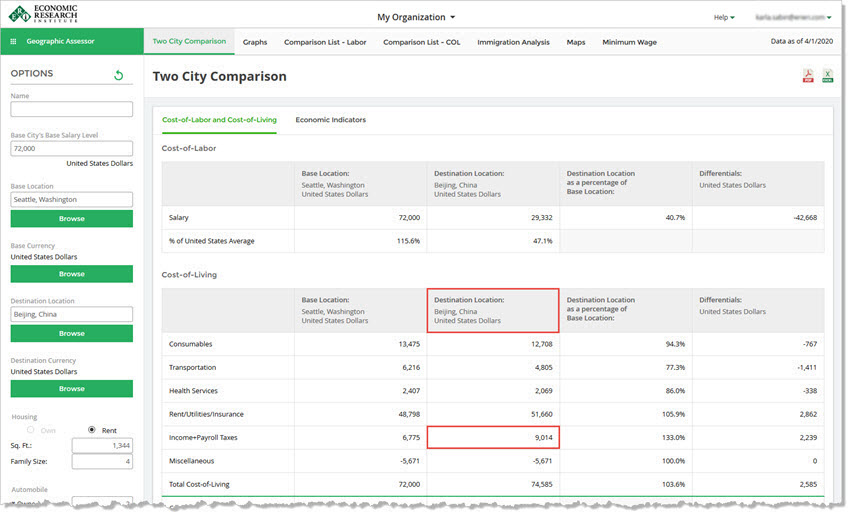

When you select "Never" in the Tax Equalization field, the destination location defaults to the US national average. Consider an example with these settings:

Tax Equalization: Never

Annual Earnings: 72,000

Base City: Seattle, WA

In this example, all Destination City locations outside of the US and Canada show $9,014 for Income+Payroll Taxes. The value of $9,014 is the tax rate for the US average. As a result, when "Never" use tax equalization is selected, the destination tax will always be $9,014 for locations outside of the US. You can rectify this by selecting a different income and payroll tax residence. This will change the destination to match the local country’s tax structure. However, the Geographic Assessor will always use the same income and payroll tax structure between the two locations. The Geographic Assessor is not able to conduct tax differentials between two tax structures.

See Tax Equalization for more information.

See Two City Comparison - Background for more information.