QUESTION: When I use the same Destination City, the same earnings level and different Base Cities, why do the values at the Destination City change when the Base City changes? Shouldn't the Destination City values stay the same?

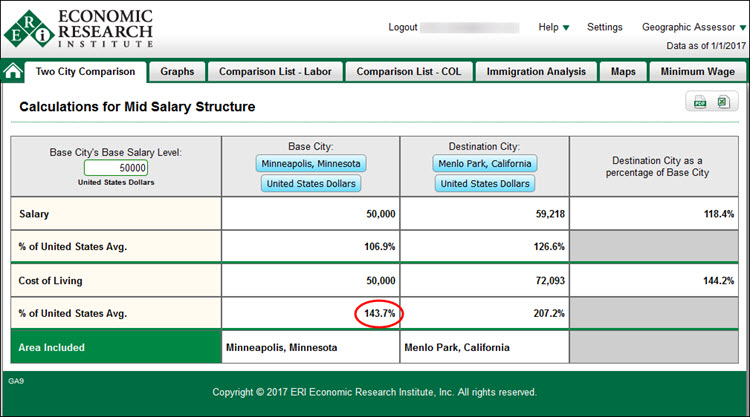

Consider the following example:

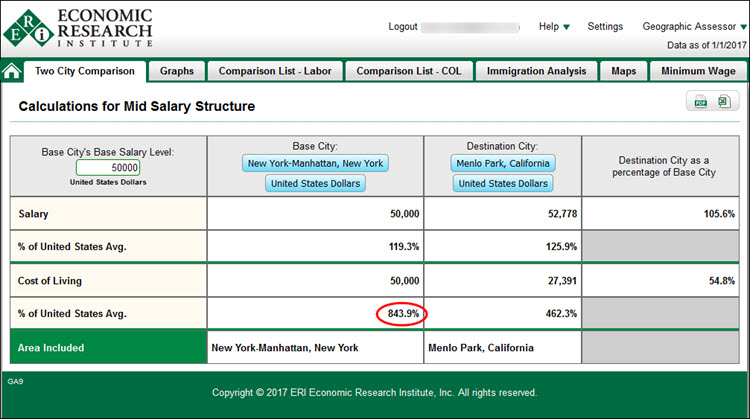

versus

The question, reworded for this example, would be: "Why aren't the Menlo Park, CA values the same in both comparisons?"

The answer is that $50,000 buys you a different lifestyle in Minneapolis (your money goes further) than in New York-Manhattan (where it buys you much less). You are comparing different spending patterns and different buying power when you change the Base City, and it follows that the Destination City costs will be different as well.

In the first comparison, $50,000 buys a lifestyle in Minneapolis that is 143.7% more expensive than the US National Average lifestyle. This translates into purchasing the equivalent of a $34,795 US National Average lifestyle. This comparison answers the question, what does it cost to buy a $50,000 Minneapolis lifestyle in Menlo Park?

In the second comparison, $50,000 buys a lifestyle in New York-Manhattan that is 843.9% more expensive than the US National Average lifestyle. This translates into purchasing the equivalent of a $5,925 US National average lifestyle. $50,000 buys you a lot less in New York-Manhattan, and the spending pattern when New York-Manhattan is the Base City will be very different than when Minneapolis is the Base City. This comparison answers the question, what does it cost to buy a $50,000 New York-Manhattan lifestyle in Menlo Park?

Please note: buying power is the inverse of cost of living. Cost of living is the cost of purchasing goods and services, as determined by the demand and supply of goods, services, and property. For example, if the cost of living is 10% higher in an area, the buying power is approximately 10% less in that area.