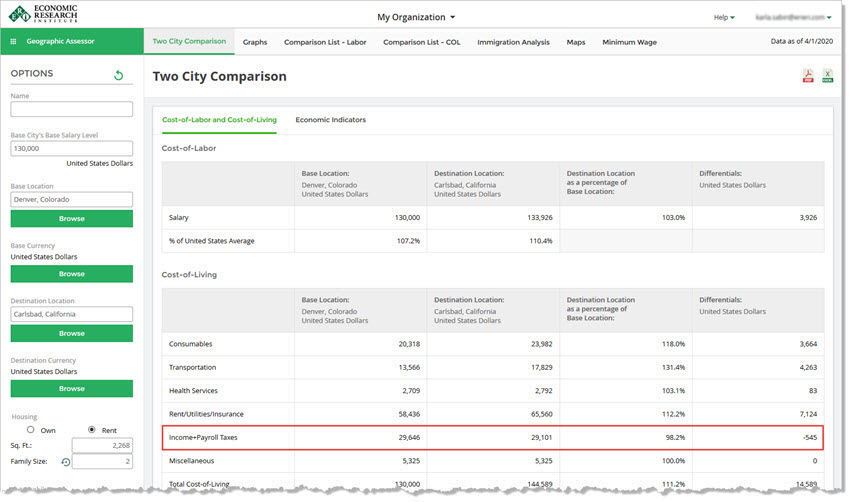

QUESTION: We are doing a relocation analysis from Denver, Colorado, to Carlsbad, California, at an earnings level of $130,000 and are surprised to find lower income + payroll taxes in California compared to Colorado. We could justify the decrease due to the deductible mortgage interest of a more expensive home in the destination, but the analysis is for a renter (not a homeowner). What is happening here?

At the time writing (2019), California has up to 5 brackets for incomes over $100,000, allowing for higher marginal rates at the highest income levels. (For example, California has 2 brackets for married couples with earnings equal to or greater than $1 million). Most other states have their highest rates at relatively lower income levels, and these almost never align with the higher income brackets of California. Therefore, the rate comparison needs to be made at the effective rate.

As of 2019, the effective tax rate in California at the relatively “low” earnings level of $130,000 is lower than the effective tax rate in Colorado, which has a flat tax rate of 4.63%. Most of the $130,000 is in tax brackets with lower marginal rates. California also allows a tax credit, which decreases the amount of the tax after the tax is calculated. Please note that the Geographic Assessor provides tax estimates, rather than a tax calculator, thus will not provide exact amounts for any individual.